Published on

Who can benefit from our services?

Retail Traders & Investors

Join us never trade alone-we help traders like you become more profitable with our proven market forecasts & signals.

Experienced Traders Seeking Validation

Have you ever second-guessed your trades? Our expert forecasts allow you to validate and confirm your own analysis.

Professionals Seeking Elliot Wave Mastery

Master Elliot Wave analysis like a pro and gain the advanced strategies needed fir successful trading.

Chart of the Day | December 30, 2025

RY (Royal Bank of Canada) Favors Rally To 187.25 or Higher

Daily & Weekly Video Forecasts

Subscribe to receive FREE Market Analysis

Don't miss out on daily video analysis, educational content, market reactions from blue boxes & subscriber only discounts.

Featured Articles, News & Analysis

Solana (SOL) Long-Term Elliott Wave View Looking for $383 – 561 Area

Solana (SOL) Long-Term Elliott Wave View Looking for $383 – 561 Area

We recently added 3 new Cryptocurrencies to our coverage. Our current cryptocurrencies service now covers Bitcoin (BTCUSD), Ethereum (ETHUSD), Dogecoin…

Microsoft ($MSFT) Up 27% Since April Entry at the Blue Box Area

Microsoft ($MSFT) Up 27% Since April Entry at the Blue Box Area

As our members know, we’ve been long in Microsoft ($MSFT) since April. The stock has made a solid rally, gaining…

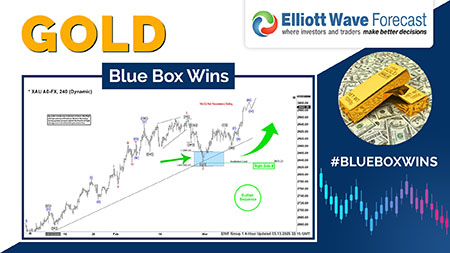

GOLD (XAUUSD) Elliott Wave : Buying the Dips at the Blue Box Area

GOLD (XAUUSD) Elliott Wave : Buying the Dips at the Blue Box Area

Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are…

Gold Miners (GDX) Buying the Dips at the Blue Box Area for More Upside

Gold Miners (GDX) Buying the Dips at the Blue Box Area for More Upside

As our members know we have had many profitable trading setups recently. In this technical article, we are going to…