RELIABLE EUR/GBP FORECAST

Daily Accurate EUR/GBP Trading Signals

1 Hour, 4 Hour, Daily & Weekly Elliott Wave Counts

Live analysis sessions and trading rooms

Daily technical videos, sequence reports & more…

EUR/GBP Forex Trading Signals

Trade with confidence with exclusive EUR/GBP Elliott Wave Forecasts

EUR/GBP is one of the popular currency pairs on the forex markets. The pair is often referred to as “Chunnel” or “Euro/Sterling” in the financial markets world. Chunnel is an abbreviation of the Channel Tunnel that joins the channel between Britain and France (Europe) In this currency pair, Euro is the base currency, and GBP is the quote currency. The exchange rate of the currency pair denotes the price of 1 unit of GBP. For instance, if the currency pair’s exchange rate is hovering around 0.87, it means it will take 0.87 Euros to purchase 1 unit of GBP.

EURGBP is a slow and trend pair; thus, it is imperative to initiate a trend direction and stay on the right side of the trend before making trading decisions. We at Elliot Wave Forecast utilize technical tools such as Elliot wave structures, market dynamics, trendlines, and Fibonacci for staying on the right side of the trend. These technical tools allow us to initiate a trend bias and remain with the trend.

For daily EUR/GBP trading forecasts, insights and technical analysis subscribe to our 14 Day Trial.

Why use Elliott Wave Forecast for EUR/GBP Currency Pair?

Let our expert analysts help you trade the right side and blue boxes with timely and reliable EUR/GBP forecasts.

- Daily & Weekly Technical Videos

- Live Chat Rooms

- Live Analysis Sessions

- Sequence Reports

- Free Education and Learning

- Live Trading Room Sessions

Don't take our word for it. See what our customers say

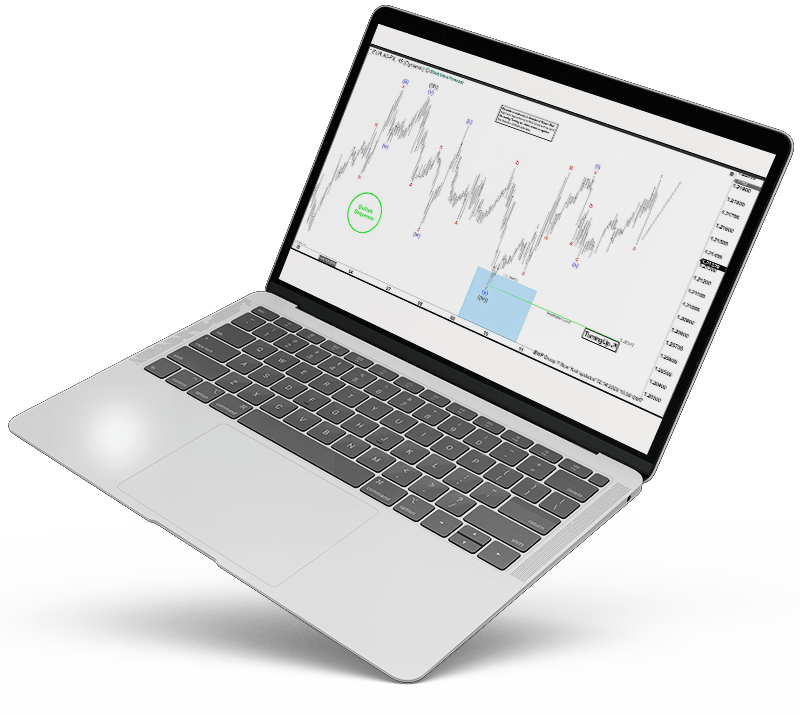

EUR/GBP Forecast using the Blue Box Approach

Our analysts and traders at Elliot Wave Forecast widely use the Blue Boxes as an area of interest on our charts. If you join our services, you will potentially witness blue boxes on every chart provided by us.

Learn to trade the right side with blue boxes.

EURGBP [27 August 2020]

Price was reaching a blue box, our members knew buyers should enter in the blue box to resume the rally or produce 3 waves reaction higher at least.

EURGBP [8 September 2020]

Pair found buyers in the blue box and rallied 200+ pips over the course of next few days allowing any traders who bought the pair in the blue box to eliminate risk on the trade.

EUR/GBP Forecast, News & Analysis

Check our updated for GBPUSD News including real-time updates, forecast, technical

analysis and the economic latest events from the best source of Forex News

EUR/GBP Forecast & Signals – Elliott Wave Analysis

Elliott wave analysis is one of the most widely used technical tools on the forex markets. Given its popularity, it is a powerful tool that allows traders to perceive potential significant market moves before happening. Elliot wave analyses are conducted by many high-end traders and investors worldwide. Elliot wave is a remarkable technical tool; however, it works the best if it is used in combination with other technical tools. Using it solely as part of your trading system can be a big mistake that may create bad trading habits implicating blowing of accounts.

Our traders and analysts at Elliott Wave Forecast conduct Elliot wave analysis using Elliott wave structures and a combination of different technical tools. These technical tools include market correlations, sequences, market dynamics, trendlines, Fibonacci, and Elliot wave structures. Using these tools allows us to attain a detailed view of the market, making us understand the potential market-moving moves before their occurrences. This way of trading will enable us to remain on the right side of the trend and don’t let us fall into the bad habit of “counter trending”!

EUR GBP Technical Analysis and EURGBP Trading Strategy

Blue Boxes

The blue boxes are especially high-frequency inflection areas designed for presenting reversal or continuation areas of interest. These blue boxes are found on such areas of the charts where there is a high probability of a trend change or continuation occurrences. The blue boxes characterize the corrective sequences of the markets. For instance, it signifies the importance of 3,7 or 11 swings to end. Moreover, the box is designed and curated by using Fibonacci extensions, cycles, and market sequences. Our blue boxes signify a vital trend and agreement between buyers and sellers on the specific area, which, in turn, allows us to stay on the right side of the trend and attain higher probability trade setups.

Fibonacci

Fibonacci is an excellent tool for identifying potential retracement areas of a trend or target levels of an existing trend. It is widely prevalent among traders and most of the traders like using it for gauging potential retracement levels of a specific trend. Our traders and analysts at Elliot wave forecast use the Fibonacci tool combined with other technical tools in our trading arsenal. For example, we use Fibonacci extensions along with sequences and wave analysis. This allows us to curate and orchestrate higher-probability areas of interest. As EURGBP is a less volatile and trendy pair, Fibonacci can be a great tool in your existing trading plan for trading the rallies and dips whenever it imitates a trend.

Trendlines

Trendlines are great tools that allow investors and traders to understand the specific market directions. For example, the trendline allows us to understand the intensity of a bear/bull trend. Generally, if the trendline is steep, it is considered a powerful trend; however, if a trendline is nearly flat or a little bit steep, it is considered a weak trend. The trendlines can be drawn from connecting the highs in a bear trend (wicks) and connecting the lows (wicks) on the bull trend. There are several ways to trade with trendlines. For instance, many traders trade with trendlines by selling/buying whenever a price reaches a significant trendline (most prominently a daily or weekly trendline). Also, most traders like to trade trendline breakouts. When the price taps, the trendlines too many times; there is a higher chance for a breakout to happen any time soon. For this reason, whenever a break happens on the trendline, there is a higher probability for the price to continue in the same direction.

As EURGBP has a low volatile nature, it can sometimes be stuck in extensive ranges and consolidations; you can use the breakout strategy to profit from it!

Market Correlations

EURGBP is considered to have positive correlations with exotic forex pairs such as CHFSGD, USD SGD, and EURMXN. This means that whenever the price of CHFSGD, USDSGD, and EUR MXN are considered to be going up, EURGBP follows it. On the other hand, EURGBP has a negative correlation with GBPNZD, GBPJPY, and GBPCHF – meaning whenever the prices of GBPJPY, GBPNZD, and GBPCHF are going up, EURGBP tends to go down. At Elliot wave forecast, we utilize the concept of first- and second-dimension market correlation, which allows us to view the market from different asset classes and pairs. This allows us to stay on the right side of the trend and attain a clear market view.

Understanding EURGBP’s low volatile nature

In the financial markets, volatility is considered one of the primary factors that promulgate account compounding or trader growth. In its essence, volatility tells us how fast an asset class, currency pair, or stock prices move. Generally, the EURGBP’s volatility is relatively low and is considered a slow pair. This means that the pair may not provide abundant and lucrative opportunities often.

The low volatility of this currency pair is that the EUR and GBP both are considered two of the most more substantial and stable currencies in the world. Ultimately, this makes the EUR GBP currency pair a stable currency pair, and traders/investors like using this pair for carry trades.

Knowing the economic news: EURGBP Fundamental Analysis

It is essential to have an eye on the economic news calendars, as high-impact news can make pairs such as EURGBP move quite substantially. For this reason, it is crucial to understand the economic events and be prepared for any substantial moves to occur. The market-moving financial data releases for the EUR GBP currency pair include GDP, Inflation numbers, monetary policies, central bank speakers’ speeches, and Brexit news. At Elliott Wave Forecast, we do not use any fundamental analysis for conducting our overall analyses of the currency pairs. On the other hand, we use various technical tools that allow us to attain precise areas of interest where the price may start a reversal or continue the existing trend.

Trade at the right hours

The forex markets are indeed open 24/5, and traders can trade the market whenever they want. However, it is crucial to understand the best hours for your favorite currency pairs, as it can bring volatility and volume to the market, creating many trading opportunities. For EUR GBP, it is essential for trading in the European session, as history proves that EURGBP moves powerfully in these hours.