RELIABLE CRYPTOCURRENCY FORECAST

Regular Cryptocurrencies Forecast and Signals

Weekly, Daily, 4 Hour and 1 Hour Elliott Wave Forecasts

Live Analysis and Live Trading Sessions

Daily, Weekly Videos & Chat Room

Free Education & Learning

Cryptocurrencies Covered

Bitcoin (BTCUSD)

Litecoin (LTCUSD)

Etherium (ETHUSD)

Cardano (ADA)

Dogecoin (DOGE)

Polygon (MATIC)

Dash (Dash)

Ripple (XRP)

Tron (TRXUSD)

Monero (XMRUSD)

Premium Elliott Wave Forecast of BTC, ETH, LTC, ADA, DOGE & MATIC

We regularly cover Bitcoin, Ethereum, Litecoin, Cardano, Dogecoin and Polygon inside members area on a daily basis, if you would like to access Elliott wave forecasts and Trading Signals for these 6 Crypto-currencies, please Subscribe or Get 14 day Trial

Bitcoin (BTC)

Ethereum (ETH)

Litecoin (LTC)

Cardano (ADA)

Dogecoin (DOGE)

Polygon (MATIC)

Free Mid-Term Analysis of the following Cryptocurrencies

Click on each of the icons below to access Free Cryptocurrencies Analysis

Click Here for XMR Free Analysis

Click Here for DASH Free Analysis

Click Here for XRP Free Analysis

Click Here for TRX Free Analysis

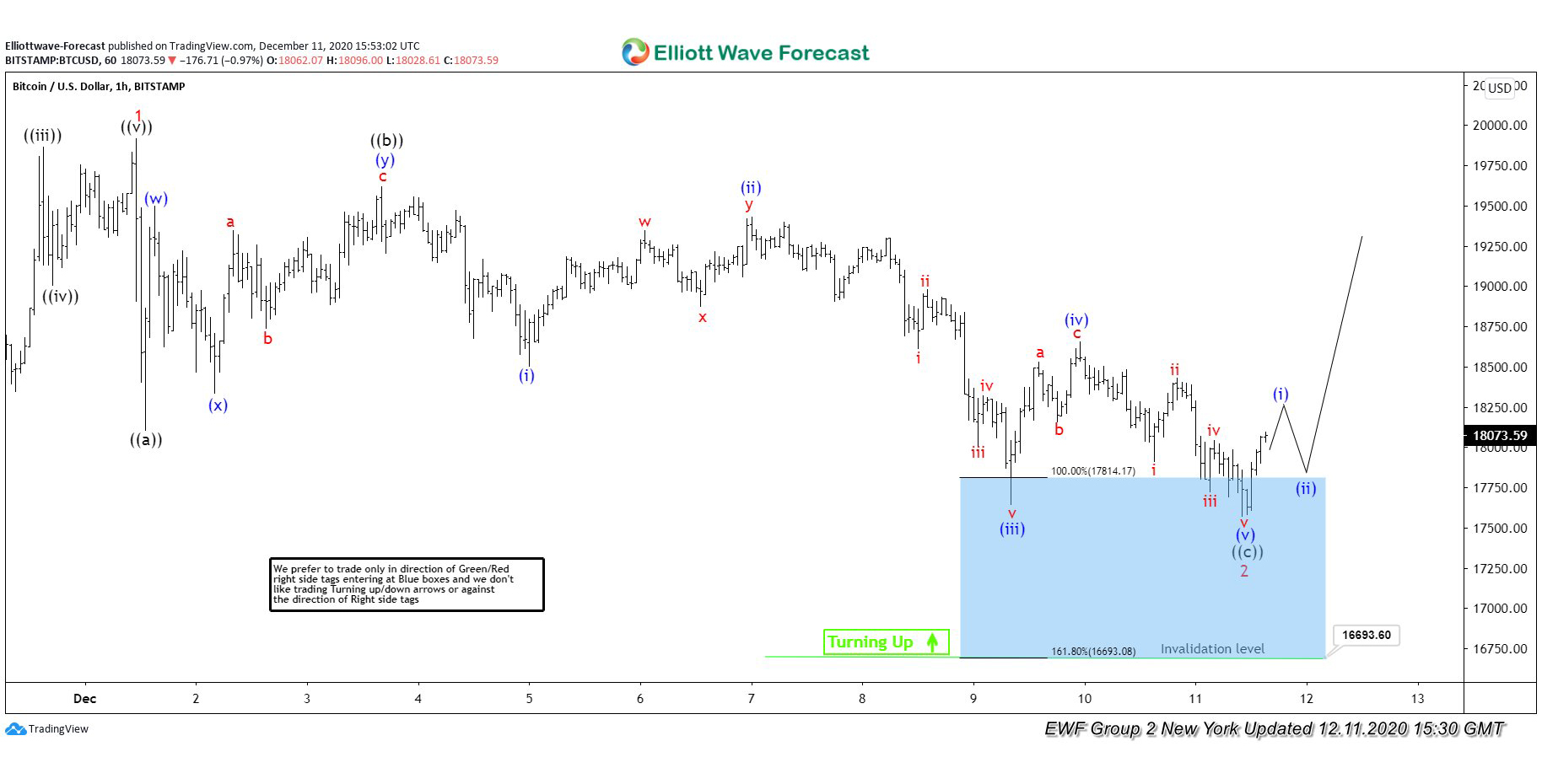

Our Blue Box Approach

Elliott Wave Forecast traders and analysts use blue boxes as a field of concern where a possible pattern turnaround or trend continuity exists. The blue boxes are uniquely built high-frequency inflection areas with precision entries on the trend’s right side and help attain precise cryptocurrency signals. Our traders orchestrated and curated these high probability areas using various technical instruments such as market patterns, sequences, wave structures, and Fibonacci retracement and extension levels. These blue boxes are always highlighted on the charts we offer to our customers, indicating a possible field of focus of high volume and liquidity for trade executions. Frequently, the blue boxes reflect the market’s corrective sequences. For example, it represents and characterizes the 3, 7, and 11 swings-to-end on our blue boxes. Such areas are regarded as very low-risk because they offer attractive investment opportunities with a greater chance of success and a higher risk-to-reward ratio.

BTCUSD [11 December 2020]

Price reached the blue box where buyers entered the markets, we expected the rally to resume or 3 waves bounce at least in Bitcoin

BTCUSD [15 December 2020]

Bitcoin resumes the rally as expected and rallied around $2000 in the next few days providing nice profits for members

What is Cryptocurrency?

Crypto-currencies are considered as a digital or virtual currency that uses cryptography to secure the transactions, it’s designed to work as a medium of exchange and to control the creation of additional units of the currency.

Bitcoin is currently the largest blockchain network by market capitalization, followed by Ethereum, Bitcoin Cash, Ripple and Litecoin.

In its essence, cryptocurrency is just a virtual or digital currency. The technology used in cryptocurrency is highly revolutionizing, as cryptographic operations securitize it. This enables the cryptocurrencies to fight against the traditional bank policies regarding double-spending and counterfeit systems. Most of the cryptocurrencies with a high market cap are decentralized, which means they exist on such networks with blockchain technology.

What is blockchain?

A blockchain is a technology that ingrains all the registered and recorded data of different regions. In regards to cryptocurrencies, the information and data are collected when the transactions take place. In short, the data is the transaction history. Thus, it elucidates how possession has changed over time.

Types of Cryptocurrency

Looking at the past, the first most popular and blockchain technology-based cryptocurrency was Bitcoin. It is still one of the most popular cryptocurrencies in the market – valued at around $60,000 at the time of writing. Currently, thousands of cryptocurrencies have been launched; these digital currencies have varying values and are considered either clones of bitcoin or better than bitcoin. Some cryptocurrencies, such as Dash, have lower transaction time than the king of all cryptocurrencies, Bitcoin. In addition, some of the other cryptocurrencies include, Litecoin (LTC), Ethereum (ETH), Binance (BnB), Dogecoin (Doge), and many more! However, these currencies are well-known in the crypto world and withhold most of the market cap in this digital financial market.

How do cryptocurrency markets work?

As you must have heard, cryptocurrencies are dominantly decentralized. This certainly means that they do not have any regulating authority, such as a central bank or any higher authority. They operate through different computer networks, and you can buy these cryptocurrencies via other exchanges and store them in your crypto wallets!

What is cryptocurrency trading?

Cryptocurrency trading has become a popular subject over the past year. Due to the volatility of these markets, they can be highly subjective to huge profits and losses. However, if you are a good trader, you can make excellent profits from these markets. You can trade cryptocurrency on CFD trading accounts and buy/sell the CFDs using the exchanges’ underlying crypto’s tokens. Moreover, you can also trade cryptocurrencies by opening a brokerage account with any of the cryptocurrency’s exchanges! Some of the well-known cryptocurrency exchanges are Coinbase, eToro, Binance, and Gemini. After opening the brokerage account, you can fund it and select any crypto currency you wish to trade! However, it is crucial to have a trading system before entering the volatile markets such as the crypto market.

Technical Analysis and Cryptocurrency Forecast

If you are new to the crypto market, you must have found yourself worrying about cryptocurrency forecasts or typing on google “cryptocurrency signals.” Well, you do not have to worry anymore. Our traders and analysts at Elliott Wave Forecast specialize in conducting technical analysis across a variety of cryptocurrencies and provide lucrative and profitable trading opportunities. Here are some of the tools we personally use, and you can also use for analyzing the crypto markets:

Elliott Wave Analysis

Elliott wave analysis is a common technological method among traders and investors in the financial markets. Elliott wave analysis provides a comprehensive view of the environment in which you are trading. It elucidates potential areas of concern for joining the market and provides a detailed forecast of the overall price movement using Elliot wave structures. Furthermore, Elliot wave analyses can be constructive in interpreting the waves that can appear on cryptocurrencies. Since the crypto market is highly unpredictable, Elliot wave analysis can be applied to crypto forecasting future massive price movements. However, it is critical not to rely solely on Elliot wave analysis as part of your trading strategy. Elliott Wave forecasting is used by our traders and researchers at Elliott Wave Forecast as part of our trading strategy, along with a broad range of technical trading methods and phenomena. For example, when our traders and analysts evaluate any cryptocurrency, forex pair, commodity, stock, or other asset class, they use a regular technical checklist. Before labeling an asset class as bullish or bearish, our traders and analysts perform thorough Fibonacci, Elliot wave models, correlation, trendlines, market patterns, sequences, and Elliot cycles analysis. This in-depth research enables them to achieve more reliable market movements and a higher win percentage. Furthermore, such in-depth analysis of various asset groups, cryptocurrencies, commodities, and stocks helps us stay on the right side of the trend! That is, we still want to trade with the trend rather than against it. The number one law in trading every financial market is “do not go against the trend.” Our traders and analysts have devised tactics to keep them on the right side of the trend, thus reducing the possibility of substantial “against the trend” losses.

Fibonacci

Fibonacci is a well-known and widely traded technical instrument in the cryptocurrency industry. The Fibonacci sequence is a very versatile technique for many applications. Traders, for example, use Fibonacci to determine future retracement thresholds on an ongoing pattern, or they use Fibonacci extensions to orchestrate their profit target levels on current positions. Elliott wave forecast traders use Fibonacci retracement and extension methods in conjunction with sequences and Elliot wave analysis. This allows one to have a more informed and precise perspective on the market on which we trade. Since cryptocurrency is such a speculative sector, it continues to produce long waves of no retracements. As a result, using the Fibonacci retracement tool to identify a retracement for buying/selling into an emerging pattern can be an extremely lucrative and efficient tactic for trading crypto markets.

Trendlines

Don’t get me wrong. Trendlines are extremely effective technical instruments. Trendlines serve many functions. Most traders use it to determine the intensity of a trend, while some use it to trade breakouts. Furthermore, by following a simple law, a trendline can be used to gauge the strength of a trend, “The steeper the trendline, the stronger the trend, and the linear the trendline, the weaker the trend.”