Elliott Wave Theory

-

3) Motive Waves

-

3.1 Impulse

-

3.2 Impulse with extension

-

3.3 Leading Diagonal

-

3.4 Ending Diagonal

-

3.5 Motive Sequence

-

-

5) Corrective Waves

-

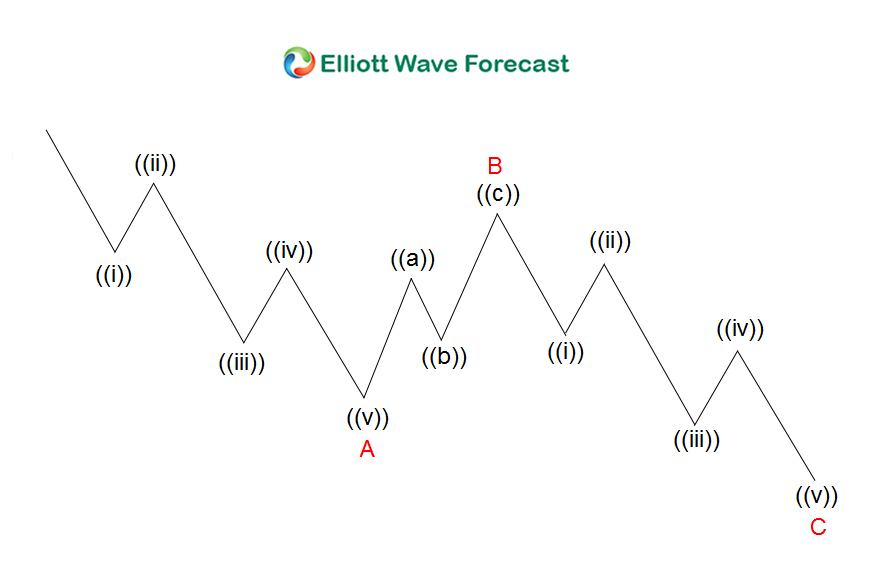

5.1 Zigzag

-

5.2 Flat

-

-

5.2.1 Regular Flats

-

5.2.2 Expanded Flats

-

5.2.3 Running Flats

-

-

-

5.3 Triangles

-

5.4 Double Three

-

5.5 Triple Three

-

-

6) 14 Day Trial

1) Elliott Wave Theory: Modern Theory for 21st Century Market

1.1 What is Elliott Wave Theory?

Elliott Wave Theory is named after Ralph Nelson Elliott (28 July 1871 – 15 January 1948). He was an American accountant and author. Inspired by the Dow Theory and by observations found throughout nature, Elliott concluded that the movement of the stock market could be predicted by observing and identifying a repetitive pattern of waves.

Elliott was able to analyze markets in greater depth, identifying the specific characteristics of wave patterns and making detailed market predictions based on the patterns. Elliott based part his work on the Dow Theory, which also defines price movement in terms of waves, but Elliott discovered the fractal nature of market action. Elliott first published his theory of the market patterns in the book titled The Wave Principle in 1938.

1.2 Basic Principle of the 1930’s Elliott Wave Theory

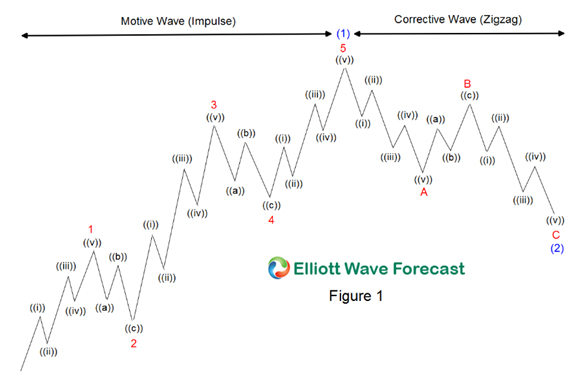

Simply put, movement in the direction of the trend is unfolding in 5 waves (called motive wave) while any correction against the trend is in three waves (called corrective wave). The movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5. The three wave correction is labelled as a, b, and c. These patterns can be seen in long term as well as short term charts.

Ideally, smaller patterns can be identified within bigger patterns. In this sense, Elliott Waves are like a piece of broccoli, where the smaller piece, if broken off from the bigger piece, does, in fact, look like the big piece. This information (about smaller patterns fitting into bigger patterns), coupled with the Fibonacci relationships between the waves, offers the trader a level of anticipation and/or prediction when searching for and identifying trading opportunities with solid reward/risk ratios.

1.3 The Five Waves Pattern (Motive and Corrective)

In Elliott’s model, market prices alternate between an impulsive, or motive phase, and a corrective phase on all time scales of trend. Impulses are always subdivided into a set of 5 lower-degree waves, alternating again between motive and corrective character, so that waves 1, 3, and 5 are impulses, and waves 2 and 4 are smaller retraces of waves 1 and 3.

In Figure 1, wave 1, 3 and 5 are motive waves and they are subdivided into 5 smaller degree impulses labelled as ((i)), ((ii)), ((iii)), ((iv)), and ((v)). Wave 2 and 4 are corrective waves and they are subdivided into 3 smaller degree waves labelled as ((a)), ((b)), and ((c)). The 5 waves move in wave 1, 2, 3, 4, and 5 make up a larger degree motive wave (1)

Corrective waves subdivide into 3 smaller-degree waves, denoted as ABC. Corrective waves start with a five-wave counter-trend impulse (wave A), a retrace (wave B), and another impulse (wave C). The 3 waves A, B, and C make up a larger degree corrective wave (2)

In a bear market the dominant trend is downward, so the pattern is reversed—five waves down and three up

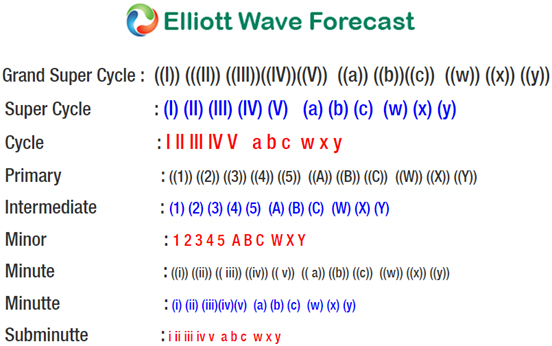

1.4 Wave Degree

Elliott Wave degree is an Elliott Wave language to identify cycles so that analyst can identify position of a wave within overall progress of the market. Elliott acknowledged 9 degrees of waves from the Grand Super Cycle degree which is usually found in weekly and monthly time frame to Subminuette degree which is found in the hourly time frame. The scheme above is used in all of EWF’s charts.

1.5 The Rise of Algorithmic / Computer-based Trading

The development of computer technology and Internet is perhaps the most important progress that shape and characterize the 21st century. The proliferation of computer-based and algorithmic trading breed a new category of traders who trade purely based on technicals, probabilities, and statistics without the human emotional aspect. In addition, these machines trade ultra fast in seconds or even milliseconds buying and selling based on proprietary algos.

No doubt the trading environment that we face today is completely different than the one in the 1930’s when Elliott first developed his wave principle. Legitimate questions arise whether Elliott Wave Principle can be applied in today’s new trading environment. After all, if it’s considered to be common sense to expect today’s cars to be different than the one in the 1930’s, why should we assume that a trading technique from 1930 can be applied to today’s trading environment?

1.6 The New Elliott Wave Principle – What is Changing in Today’s Market

The biggest change in today’s market compared to the one in 1930s is in the definition of a trend and counter-trend move. We have four major classes of market: Stock market, forex, commodities, and bonds. The Elliott Wave Theory was originally derived from the observation of the stock market (i.e. Dow Theory), but certain markets such as forex exhibit more of a ranging market.

In today’s market, 5 waves move still happen in the market, but our years of observation suggest that a 3 waves move happens more frequently in the market than a 5 waves move. In addition, market can keep moving in a corrective structure in the same direction. In other words, the market can trend in a corrective structure; it keeps moving in the sequence of 3 waves, getting a pullback, then continue the same direction again in a 3 waves corrective move. Thus, we believe in today’s market, trends do not have to be in 5 waves and trends can unfold in 3 waves. It’s therefore important not to force everything in 5 waves when trying to find the trend and label the chart.

2) Fibonacci

2.1 Introduction

Leonardo Fibonacci da Pisa is a thirteenth century mathematician who discovered the Fibonacci sequence. In 1242, he published a paper entitled Liber Abacci which introduced the decimal system. The basis of the work came from a two-year study of the pyramids at Giza. Fibonacci is most famous for his Fibonacci Summation series which enabled the Old World in the 13th century to switch from Roman numbering (XXIV = 24) to the Arabic numbering (24) that we use today. For his work in mathematics, Fibonacci was awarded the equivalent of today’s Nobel Prize.

2.2 Fibonacci Summation Series

One of the most popular discoveries by Leonardo Fibonacci is the Fibonacci Summation series. This series takes 0 and adds 1 as the first two numbers. Succeeding numbers in the series adds the previous two numbers and thus we have 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89 to infinity. The Golden Ratio (1.618) is derived by dividing a Fibonacci number with another previous Fibonacci number in the series. As an example, 89 divided by 55 would result in 1.618.

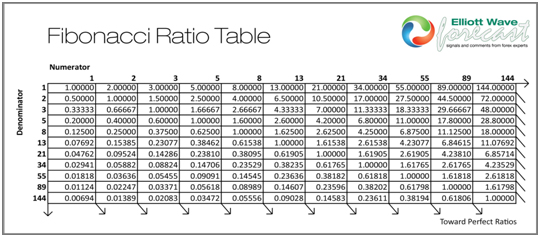

2.3 Fibonacci Ratio Table

Various Fibonacci ratios can be created in a table shown below where a Fibonacci number (numerator) is divided by another Fibonacci number (denominator). These ratios, and several others derived from them, appear in nature everywhere, and in the financial markets. They often indicate levels at which strong resistance and support will be found. They are easily seen in nature (seashell spirals, flower petals, structure of tree branches, etc), art, geometry, architecture, and music.

Some of the key Fibonacci ratios can be derived as follow:

• 0.618 is derived by dividing any Fibonacci number in the sequence by another Fibonacci number that immediately follows it. For example, 8 divided by 13 or 55 divided by 89

• 0.382 is derived by dividing any Fibonacci number in the sequence by another Fibonacci number that is found two places to the right in the sequence. For example, 34 divided by 89

• 1.618 (Golden Ratio) is derived by dividing any Fibonacci number in the sequence by another Fibonacci number that is found 1 place to the left in the sequence. For example, 89 divided by 55, 144 divided by 89

2.4 Fibonacci Retracement and Extension

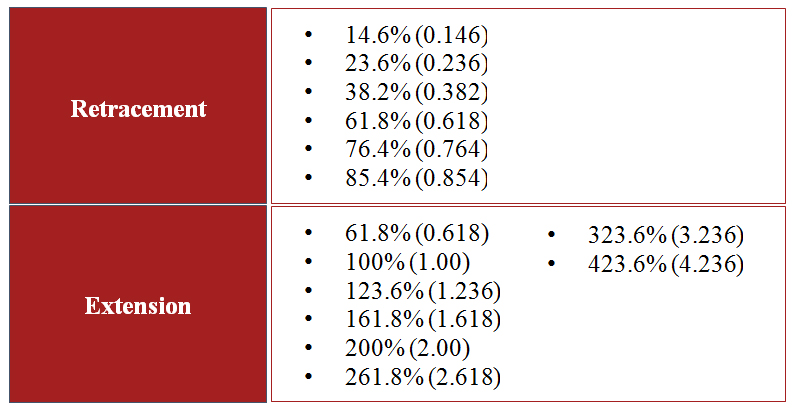

Fibonacci Retracement in technical analysis and in Elliott Wave Theory refers to a market correction (counter trend) which is expected to end at the areas of support or resistance denoted by key Fibonacci levels. The market is then expected to turn and resume the trend again in the primary direction.

Fibonacci Extension refers to the market moving with the primary trend into an areas of support and resistance at key Fibonacci levels where target profit is measured. Traders use the Fibonacci Extension to determine their target profit.

Below is the list of important Fibonacci Retracement and Fibonacci Extension ratios for the financial market:

2.5 Relation Between Fibonacci and Elliott Wave Theory

Fibonacci Ratio is useful to measure the target of a wave’s move within an Elliott Wave structure. Different waves in an Elliott Wave structure relates to one another with Fibonacci Ratio. For example, in impulse wave:

- • Wave 2 is typically 50%, 61.8%, 76.4%, or 85.4% of wave 1

- • Wave 3 is typically 161.8% of wave 1

- • Wave 4 is typically 14.6%, 23.6%, or 38.2% of wave 3

- • Wave 5 is typically inverse 1.236 – 1.618% of wave 4, equal to wave 1 or 61.8% of wave 1+3

Traders can thus use the information above to determine the point of entry and profit target when entering into a trade.

3) Motive Waves

In Elliott Wave Theory, the traditional definition of motive wave is a 5 wave move in the same direction as the trend of one larger degree. There are three different variations of a 5 wave move which is considered a motive wave: Impulse wave, Impulse with extension, and diagonal.

EWF prefers to define motive wave in a different way. We agree that motive waves move in the same direction as the trend and we also agree that 5 waves move is a motive wave. However, we think that motive waves do not have to be in 5 waves. In today’s market, motive waves can unfold in 3 waves. For this reason, we prefer to call it motive sequence instead.

3.1 Impulse

Guidelines

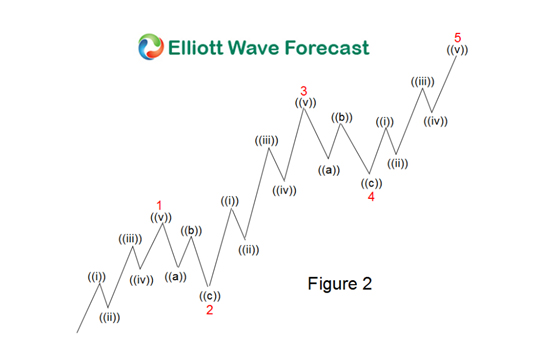

- • Impulse wave subdivide into 5 waves. In Figure 2, the impulse move is subdivided as 1, 2, 3, 4, 5in minor degree

- • Wave 1, 3, and 5 subdivision are impulse. The subdivision in this case is ((i)), ((ii)), ((iii)), ((iv)), and ((v)) in minute degree.

- • Wave 2 can’t retrace more than the beginning of wave 1

- • Wave 3 can not be the shortest wave of the three impulse waves, namely wave 1, 3, and 5

- • Wave 4 does not overlap with the price territory of wave 1

- • Wave 5 needs to end with momentum divergence

Fibonacci Ratio Relationship

- • Wave 2 is 50%, 61.8%, 76.4%, or 85.4% of wave 1

- • Wave 3 is 161.8%, 200%, 261.8%, or 323.6% of wave 1-2

- • Wave 4 is 14.6%, 23.6%, or 38.2% of wave 3 but no more than 50%

- • There are three different ways to measure wave 5. First, wave 5 is inverse 123.6 – 161.8% retracement of wave 4. Second, wave 5 is equal to wave 1. Third, wave 5 is 61.8% of wave 1-3

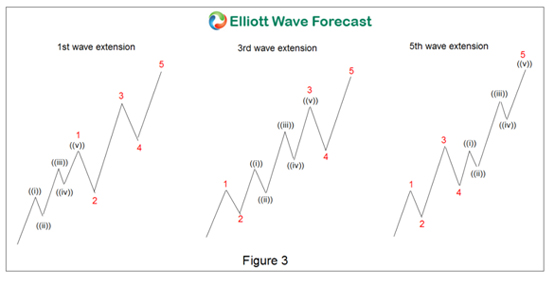

3.2 Impulse with Extension

Guidelines

- • Impulses usually have an extension in one of the motive waves (either wave 1, 3, or 5)

- • Extensions are elongated impulses with exaggerated subdivisions

- • Extensions frequently occur in the third wave in the stock market and forex market. Commodities market commonly develop extensions in the fifth wave

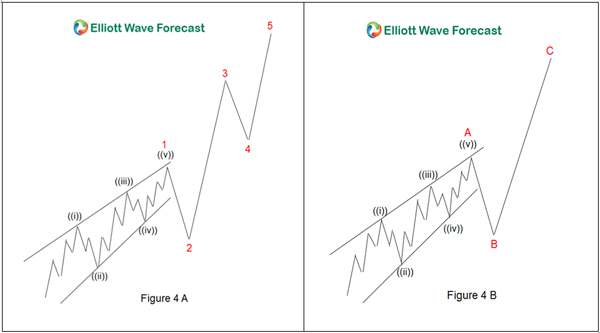

3.3 Leading Diagonal

Guidelines

- • Special type of motive wave which appears as subdivision of wave 1 in an impulse or subdivision of wave A in a zigzag

- • In Figure 4A, the leading diagonal is a subdivision of wave 1 in an impulse. In Figure 4B, the leading diagonal is a subdivision of wave A in a zigzag

- • Leading diagonal is usually characterized by overlapping wave 1 and 4 and also by the wedge shape but overlap between wave 1 and 4 is not a condition, it may or may not happen

- • The subdivision of a leading diagonal can be 5-3-5-3-5 or 3-3-3-3-3. The examples above show a leading diagonal with 5-3-5-3-5 subdivision

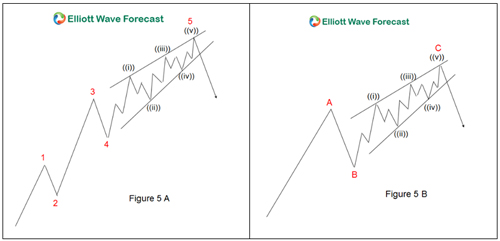

3.4 Ending Diagonal

Guidelines

- • Special type of motive wave which appears as subdivision of wave 5 in an impulse or subdivision of wave C in a zigzag

- • In Figure 5A, the ending diagonal is a subdivision of wave 5 in an impulse. In Figure 5B, the ending diagonal is a subdivision of wave C in a zigzag

- • Ending diagonal is usually characterized by overlapping wave 1 and 4 and also by the wedge shape. However, overlap between wave 1 and 4 is not a condition and it may or may not happen

- • The subdivision of an ending diagonal is either 3-3-3-3-3 or 5-3-5-3-5

3.5 Motive Sequence

Motive waves move in the same direction of the primary trend, but in today’s time, we believe it doesn’t necessarily have to be in impulse. We instead prefer to call it motive sequence.We define a motive sequence simply as an incomplete sequence of waves (swings). The structure of the waves can be corrective, but the sequence of the swings will be able to tell us whether the move is over or whether we should expect an extension in the existing direction.

Motive sequence is much like the Fibonacci number sequence. If we discover the number of swings on the chart is one of the numbers in the motive sequence, then we can expect the current trend to extend further.

Motive Sequence: 5, 9, 13, 17, 21, 25, 29, …

4) Waves Personality

4.1 Wave 1 and wave 2

Wave 1: In Elliott Wave Theory, wave one is rarely obvious at its inception. When the first wave of a new bull market begins, the fundamental news is almost universally negative. The previous trend is considered still strongly in force. Fundamental analysts continue to revise their earnings estimates lower; the economy probably does not look strong. Sentiment surveys are decidedly bearish, put options are in vogue, and implied volatility in the options market is high. Volume might increase a bit as prices rise, but not by enough to alert many technical analysts

Wave 2: In Elliott Wave Theory, wave two corrects wave one, but can never extend beyond the starting point of wave one. Typically, the news is still bad. As prices retest the prior low, bearish sentiment quickly builds, and “the crowd” haughtily reminds all that the bear market is still deeply ensconced. Still, some positive signs appear for those who are looking: volume should be lower during wave two than during wave one, prices usually do not retrace more than 61.8% (see Fibonacci section below) of the wave one gains, and prices should fall in a three wave pattern

4.2 Wave 3

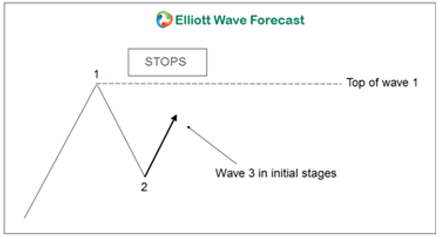

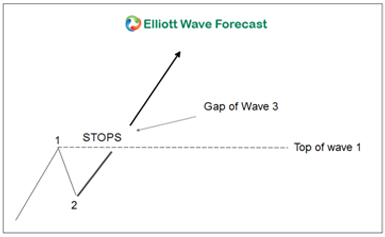

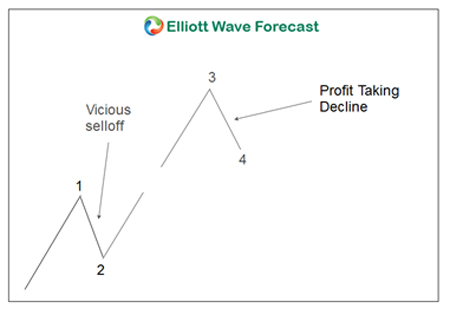

Wave 3: In Elliott Wave Theory, wave three is usually the largest and most powerful wave in a trend (although some research suggests that in commodity markets, wave five is the largest). The news is now positive and fundamental analysts start to raise earnings estimates. Prices rise quickly, corrections are short-lived and shallow. Anyone looking to “get in on a pullback” will likely miss the boat. As wave three starts, the news is probably still bearish, and most market players remain negative; but by wave three’s midpoint, “the crowd” will often join the new bullish trend. Wave three often extends wave one by a ratio of 1.618:1

Wave 3 rally picks up steam and takes the top of Wave 1. As soon as the Wave 1 high is exceeded, the stops are taken out. Depending on the number of stops, gaps are left open. Gaps are a good indication of a Wave 3 in progress. After taking the stops out, the Wave 3 rally has caught the attention of traders

4.3 Wave 4

At the end of wave 4, more buying sets in and prices start to rally again. Wave four is typically clearly corrective. Prices may meander sideways for an extended period, and wave four typically retraces less than 38.2% of wave three. Volume is well below than that of wave three. This is a good place to buy a pull back if you understand the potential ahead for wave 5. Still, fourth waves are often frustrating because of their lack of progress in the larger trend.

4.4 Wave 5

Wave 5: In Elliott Wave Theory, wave five is the final leg in the direction of the dominant trend. The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top. Volume is often lower in wave five than in wave three, and many momentum indicators start to show divergences (prices reach a new high but the indicators do not reach a new peak). At the end of a major bull market, bears may very well be ridiculed (recall how forecasts for a top in the stock market during 2000 were received)

The wave 5 lacks huge enthusiasm and strength found in the wave 3 rally. Wave 5 advance is caused by a small group of traders.Although the prices make a new high above the top of wave 3, the rate of power or strength inside wave 5 advance is very small when compared to wave 3 advance

4.5 Wave A, B, and C

Wave A: Corrections are typically harder to identify than impulse moves. In wave A of a bear market, the fundamental news is usually still positive. Most analysts see the drop as a correction in a still-active bull market. Some technical indicators that accompany wave A include increased volume, rising implied volatility in the options markets and possibly a turn higher in open interest in related futures markets

Wave B: Prices reverse higher, which many see as a resumption of the now long-gone bull market. Those familiar with classical technical analysis may see the peak as the right shoulder of a head and shoulders reversal pattern. The volume during wave B should be lower than in wave A. By this point, fundamentals are probably no longer improving, but they most likely have not yet turned negative

Wave C: Prices move impulsively lower in five waves. Volume picks up, and by the third leg of wave C, almost everyone realizes that a bear market is firmly entrenched. Wave C is typically at least as large as wave A and often extends to 1.618 times wave A or beyond

5) Corrective Waves

The classic definition of corrective waves is waves that move against the trend of one greater degree. Corrective waves have a lot more variety and less clearly identifiable compared to impulse waves. Sometimes it can be rather difficult to identify corrective patterns until they are completed. However, as we have explained above, both trend and counter-trend can unfold in corrective pattern in today’s market, especially in forex market. Corrective waves are probably better defined as waves that move in three, but never in five. Only motive waves are fives.

There are five types of corrective patterns:

- • Zigzag (5-3-5)

- • Flat (3-3-5)

- • Triangle (3-3-3-3-3)

- • Double three: A combination of two corrective patterns above

- • Triple three: A combination of three corrective patterns above

5.1 Zigzag

Guidelines

- • Zigzag is a corrective 3 waves structure labelled as ABC

- • Subdivision of wave A and C is 5 waves, either impulse or diagonal

- • Wave B can be any corrective structure

- • Zigzag is a 5-3-5 structure

Fibonacci Ratio Relationship

- • Wave B = 50%, 61.8%, 76.4% or 85.4% of wave A

- • Wave C = 61.8%, 100%, or 123.6% of wave A

- • If wave C = 161.8% of wave A, wave C can be a wave 3 of a 5 waves impulse. Thus, one way to label between ABC and impulse is whether the third swing has extension or not

5.2 Flat

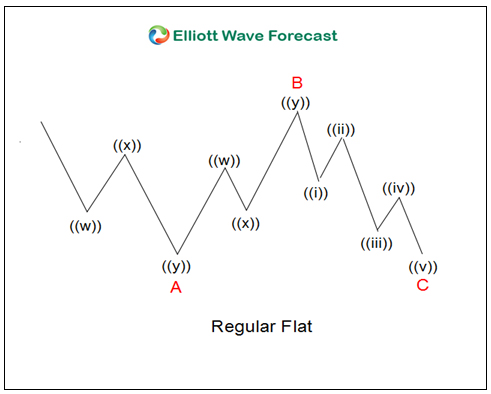

A flat correction is a 3 waves corrective move labelled as ABC. Although the labelling is the same, flat differs from zigzag in the subdivision of the wave A. Whereas Zigzag is a 5-3-5 structure, Flat is a 3-3-5 structure. There are three different types of Flats: Regular, Irregular / Expanded, and Running Flats.

5.2.1 Regular Flats

Guidelines

- • A corrective 3 waves move labelled as ABC

- • Subdivision of wave A and B is in 3 waves

- • Subdivision of wave C is in 5 waves impulse / diagonal

- • Subdivision of wave A and B can be in any corrective 3 waves structure including zigzag, flat, double three, triple three

- • Wave B terminates near the start of wave A

- • Wave C generally terminates slightly beyond the end of wave A

- • Wave C needs to have momentum divergence

Fibonacci Ratio Relationship

- • Wave B = 90% of wave A

- • Wave C = 61.8%, 100%, or 123.6% of wave AB

5.2.2 Expanded Flats

Guidelines

- • A corrective 3 waves move labelled as ABC

- • Subdivision of wave A and B is in 3 waves

- • Subdivision of wave C is in 5 waves impulse / diagonal

- • Subdivision of wave A and B can be in any corrective 3 waves structure including zigzag, flat, double three, triple three

- • Wave B of the 3-3-5 pattern terminates beyond the starting level of wave A

- • Wave C ends substantially beyond the ending level of wave A

- • Wave C needs to have momentum divergence

Fibonacci Ratio Relationship

- • Wave B = 123.6% of wave A

- • Wave C = 123.6% – 161.8% of wave AB

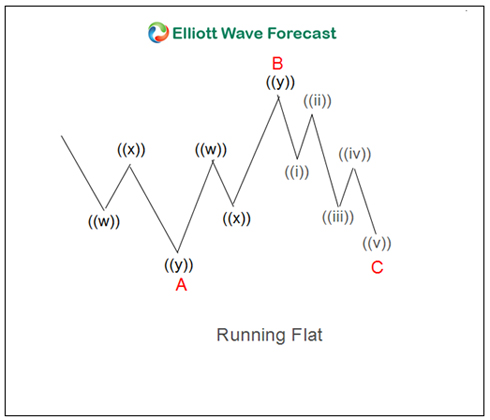

5.2.3 Running Flats

Guidelines

- • A corrective 3 waves move labelled as ABC

- • Subdivision of wave A and B is in 3 waves

- • Subdivision of wave C is in 5 waves impulse / diagonal

- • Subdivision of wave A and B can be in any corrective 3 waves structure including zigzag, flat, double three, triple three

- • Wave B of the 3-3-5 pattern terminates substantially beyond the starting level of wave A as in an expanded flat

- • Wave C fails travel the full distance, falling short of the level where wave A ended

- • Wave C needs to have momentum divergence

Fibonacci Ratio Relationship

- • Wave B = 123.6% of wave A

- • Wave C = 61.8% – 100% of wave AB

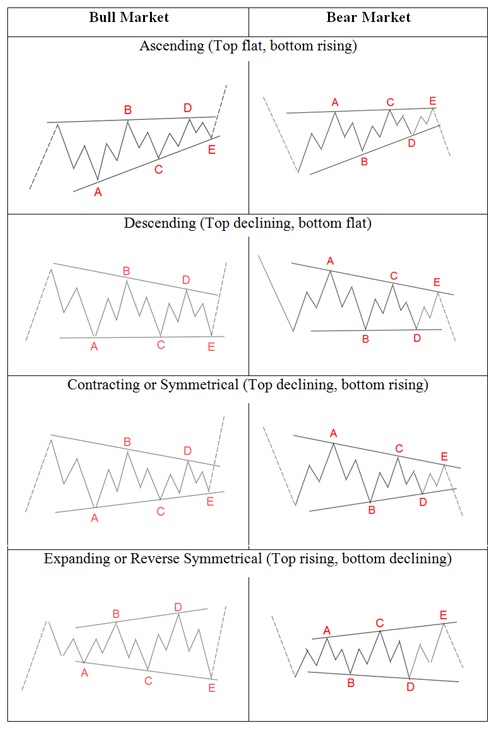

5.3 Triangles

A triangle is a sideways movement that is associated with decreasing volume and volatility. Triangles have 5 sides and each side is subdivided in 3 waves hence forming 3-3-3-3-3 structure. There are 4 types of triangles in Elliott Wave Theory: Ascending, descending, contracting, and expanding. They are illustrated in the graphic below

Guidelines

- • Corrective structure labelled as ABCDE

- • Usually happens in wave B or wave 4

- • Subdivided into three (3-3-3-3-3)

- • RSI also needs to support the triangle in every time frame

- • Subdivision of ABCDE can be either abc, wxy, or flat

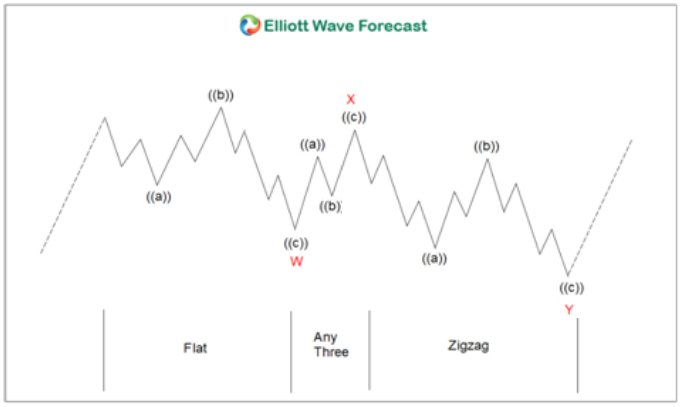

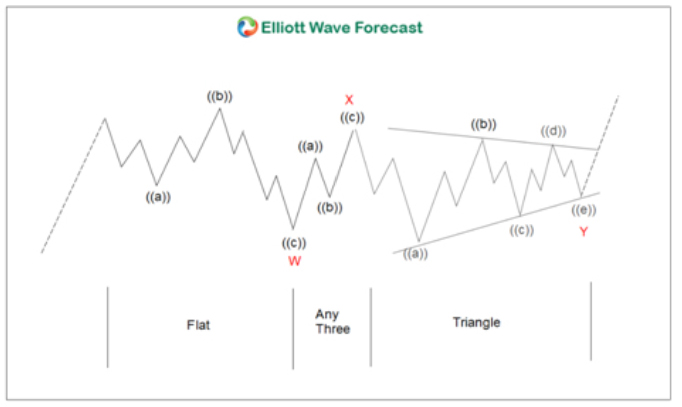

5.4 Double Three

Double three is a sideways combination of two corrective patterns. We’ve already looked at several corrective patterns including zigzag, flat, and triangle. When two of these corrective patterns are combined together, we get a double three. In addition,

Guidelines

- • A combination of two corrective structures labelled as WXY

- • Wave W and wave Y subdivision can be zigzag, flat, double three of smaller degree, or triple three of smaller degree

- • Wave X can be any corrective structure

- • WXY is a 7 swing structure

Fibonacci Ratio Relationship

- • Wave X = 50%, 61.8%, 76.4%, or 85.4% of wave W

- • Wave Y = 61.8%, 100%, or 123.6% of wave W

- • Wave Y can not pass 161.8% of wave W

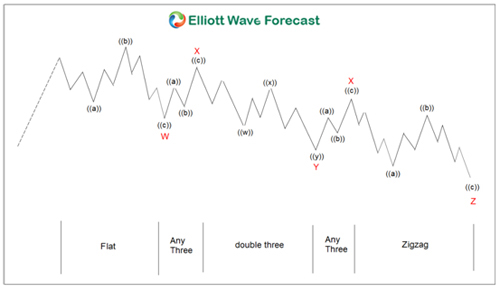

Below are examples of different combinations of two corrective structures which form the double threes:

Above figure is a combination of a flat and a zigzag

Above figure is a combination of a flat and a triangle

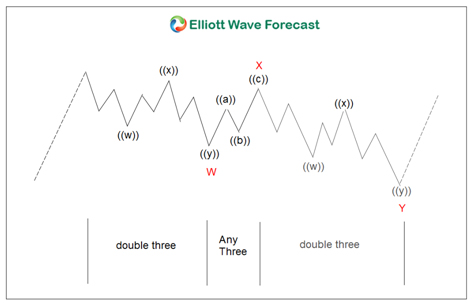

Above figure is a combination of two double threes of lesser degree

5.5 Triple Three

Triple three is a sideways combination of three corrective patterns in Elliott Wave Theory

Guidelines

- • A combination of three corrective structures labelled as WXYXZ

- • Wave W, wave Y, and wave Z subdivision can be zigzag, flat, double three of smaller degree, or triple three of smaller degree

- • Wave X can be any corrective structure

- • WXYZ is an 11 swing structure

Fibonacci Ratio Relationship in Elliott Wave Theory

- • Wave X = 50%, 61.8%, 76.4%, or 85.4% of wave W

- • Wave Z = 61.8%, 100%, or 123.6% of wave W

- • Wave Y can not pass 161.8% of wave W or it can become an impulsive wave 3

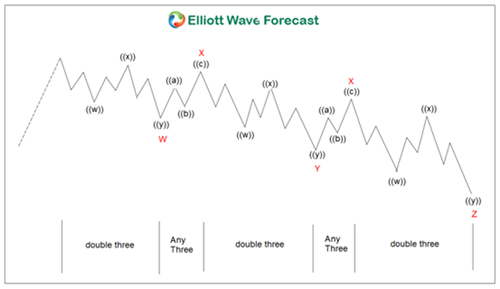

Below are examples of different combinations of three corrective structures which form the triple threes:

Above figure is a combination of a flat, double three, and zigzag

Above figure is a combination of three double threes