RELIABLE GOLD FORECAST

Daily Accurate Gold (XAU) Trading Signals

1 Hour, 4 Hour, Daily & Weekly Elliott Wave Counts

Live analysis sessions and trading rooms

Daily technical videos, sequence reports & more…

Gold Trading Signals

Trade with confidence with exclusive Elliott Wave Forecasts

Because of its unique position even inside the globe’s economic systems, the gold market delivers enormous volatility and remarkable ability to gain in nearly any conditions, whether gold is in a bearish or a bullish cycle. Though many individuals prefer to purchase the commodity directly, wagering in the derivatives, equities, and options markets gives significant leverage with acceptable risk exposure.

Financial market participants generally struggle to benefit from gold price variations as they are uninformed of the specific characteristics of the global gold marketplace or the underlying risks that can steal advantages. Furthermore, not all financial vehicles are built similarly: Several metal instruments are far more likely than others to generate dependable and consistent outcomes.

Trading precious metal is not brutal to learn. Still, it does demand technical abilities that are exclusive to only this trade. New traders should continue cautiously, but experienced investors will benefit from adopting several specialized tools that operate well on the yellow gold. Meanwhile, we will discuss a little more about gold and then cover the required technical analysis performed at Elliott Wave Forecast to efficiently trade gold!

Why use Elliott Wave Forecast for Gold?

Let our expert analysts help you trade the right side and blue boxes with timely and reliable Gold forecasts.

- Daily & Weekly Technical Videos

- Live Chat Rooms

- Live Analysis Sessions

- Sequence Reports

- Free Education and Learning

- Live Trading Room Sessions

Don't take our word for it. See what our customers say

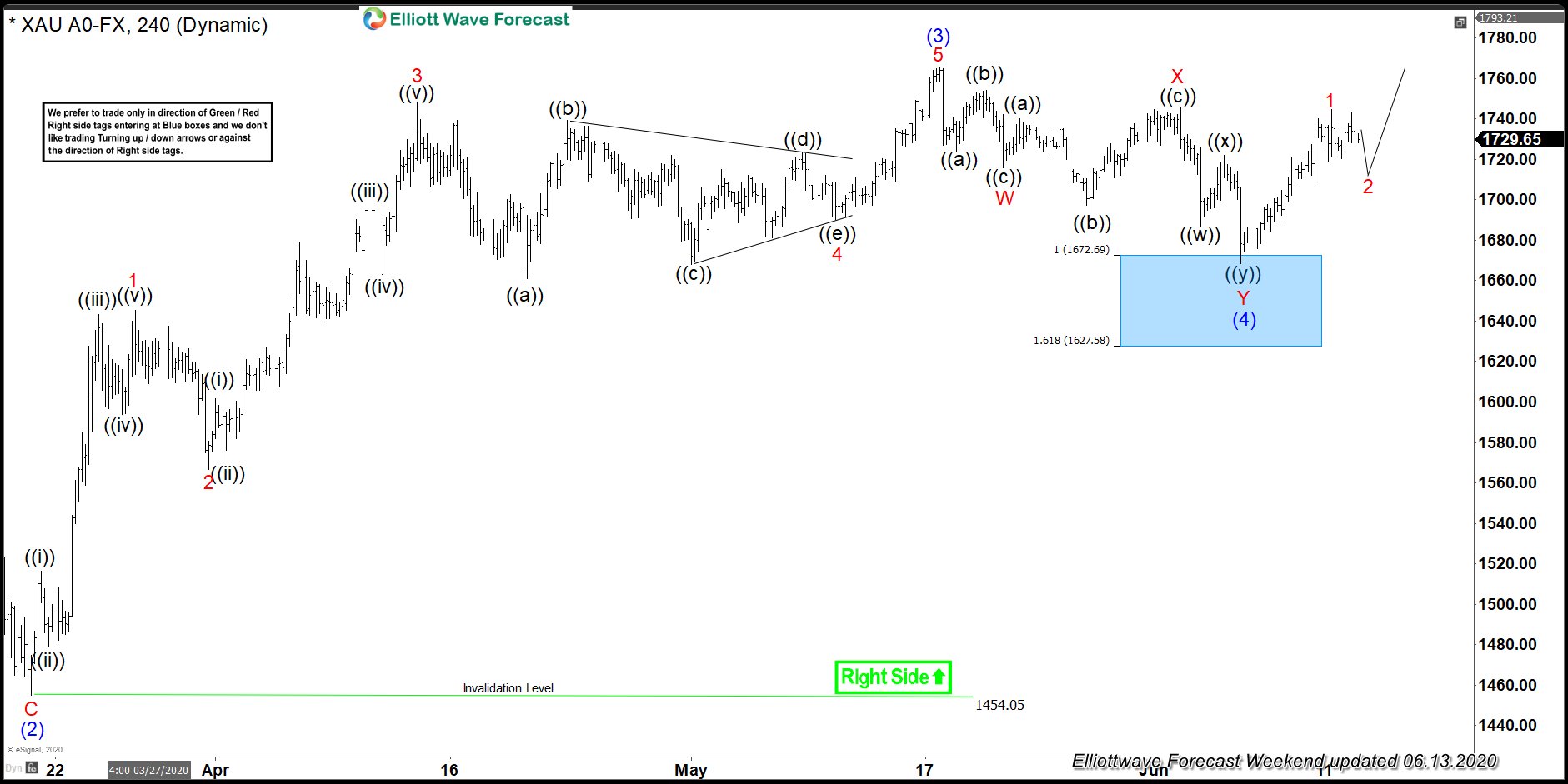

Gold Forecast using the Blue Box Approach

Elliott wave prediction specialists and traders commonly employ the Blue Boxes as an area of interest on our charts. If you utilize our services, you may notice blue boxes on every chart we present. These boxes are high-frequency inflection zones meant to depict a reversal or continuation of areas of interest. These blue boxes show on charts when there is a substantial possibility of a trend change or continuation occurring. The blue boxes show the market’s corrective sequences. For example, it symbolizes the importance of 3, 7, or 11 swings to complete. Furthermore, the box is constructed and controlled using Fibonacci extensions, cycles, and market sequences in mind. Our blue boxes show a major trend and agreement between buyers and sellers in a given location, enabling us to stay on the right side of the trend and accomplish increased probability trade settings.

Learn to trade the right side with blue boxes.

Gold [4 June 2020]

Showed 5 swings incomplete sequence from the peak of wave (3). We expected another swing lower to reach the blue box before buyers entered the market again

Gold [13 June 2020]

Gold found buyers in the blue box and rallied over $70 in the next few trading days allowing any traders who bought it in the blue box to move stop to entry level.

Gold Forecast, News & Analysis

Check our updated for Gold News including real-time updates, forecast, technical analysis and the economic latest events from the best source of Commodities News

Gold Forecast & Signals – Trading Gold vs Forex

Gold has traditionally been viewed as a measure of wealth since, unlike money, it is not vulnerable to the impulses of central bankers. Gold prices are not considerably impacted by either macroeconomic policy and always will be valued some — and unlike money, which may become almost worthless due to uncontrolled inflation.

Investors may also employ gold as a “safe haven,” combined with assets such as the yen, the Franc, and Treasury securities and bond funds. That is, when investors are worried about risk patterns, they will attempt to purchase safe-haven assets. On the other hand, when risk aversion grows, investors prefer to liquidate safe holdings in favor of stocks and other investments with increasing interest rates. As a consequence, gold is a critical inflation hedge and a prized asset.

However, whereas the Franc and Yen may be traded against various economies, gold is nearly solely traded with the Us Dollar. As a consequence, trading gold entails paying attention to the changes of the US dollar. For instance, if the price of the US dollar really grows, the gold price may decline. Traders at Elliott Wave Forecast utilize DXY and US DOLLAR index as the primary gauge for interpreting gold movements.

Market liquidity is another critical item to consider when researching how to trade gold. According to the World Gold Council, daily trade volume in gold is higher than just about every other currency pair except EURUSD. This makes it higher than the market capitalization in EURJPY.

Technical Analysis of Gold and Trading Strategy

HOW TO USE TECHNICAL ANALYSIS TO TRADE GOLDTechnical traders will study how the gold price chart’s market situation has shifted over time. This helps them notice the general trend of the market and where the market could go in the future. At Elliot wave forecast, we perform technical analysis using various specialized instruments, enabling us to accomplish more confluences to our trade setups and remain at the right side of the trend!

Elliott Wave Analysis

Elliott wave analysis is a standard technical analysis methodology in the forex market. Not to mention, given its significance, it is a handy tool that assists traders in predicting possible important market movements before they occur. Many great investors and traders across the world employ Elliot wave analysis. The Elliot wave is a terrific technical instrument; yet, it works best when paired with other tools. Using it solely as a component of your trading strategy may be a huge blunder that may lead to undesirable investment habits and account wasting. Elliot wave research is carried out by our trader and strategists at Elliott Wave Forecast, employing Elliot wave structures in combination with a range of technical tools. Market correlations, sequences, market dynamics, trendlines, Fibonacci, and Elliot wave structures are among the technological tools accessible. Using these tools helps us have a sweeping view of the market, enabling us to forecast potential market altering movements. Furthermore, this way of trading allows us to remain on the right side of the trend and prevent the harmful habit of “counter trending”!

Fibonacci

Fibonacci is a good technique for finding possible trend retracement regions or objective levels of an existing trend. It is extensively employed by traders. The bulk of them utilizes it to estimate anticipated retracement levels of a specific trend. Elliot wave prediction traders and analysts apply the Fibonacci tool in combination with other approaches in our trading inventory. We apply for Fibonacci extensions, for example, in combination with sequences and wave analysis. This helps us to arrange and coordinate higher probability areas of interest. Because gold may be a trendy and volatile commodity, Fibonacci may be a superb instrument in your present trading strategy for trading spikes and falls!

Trendlines

Trendlines are fantastic tools for investors and traders to utilize in identifying market direction. The trendline, for example, lets us gauge the strength of a bear/bull trend. In general, a steep trendline denotes a strong trend; yet, a nearly flat or slightly steep trendline suggests a moderate trend. Trendlines may be established by joining the highs (wicks) in a bear trend and the lows (wicks) in a bull trend. Trendlines may be traded in several ways. Many traders, for example, trade using trendlines by selling/buying anytime the price approaches a critical trendline (most prominently a daily or weekly trendline) (most prominently a daily or weekly trendline). Furthermore, several investors prefer to trade trendline breakouts; when the market contacts the trendlines too frequently, a more significant likelihood will occur soon. Consequently, every time the trendline is broken, there is a more significant possibility that the price will continue in the same precise direction.

Because gold is so volatile, it may periodically get caught in long trends that never seem to end! Traders may profit from such long-never-ending gold cycles by building a trendline and connecting either lows or highs (depending on the trend)

Correlations in the Market

Gold prices are highly correlated with AUDUSD and dollar index prices. The latter (AUDUSD) is positively correlated gold due to different reasons. One of the primary fundamental reasons is that Australia is one of the biggest producers of gold, so whenever the gold prices are going up, AUDUSD tends to move up. On the other hand, as gold is pegged with the dollar as a base currency, gold tends to move in the opposite direction whenever the dollar’s price is moving up or down. We at Elliot wave forecast undertake different market correlation methodologies, including first- and second-dimension market correlations. This allows us to understand the market we are trading in a clear and bird’s eye view, and also this will enable us to remain on the right side of the trend!

Trading Hours for Gold

Finally, gold trading hours are almost 24 hours a day. Gold markets are nearly always functioning, with trading moving quickly from London to new york and Asian session. This means that availability is ample at the time, but, as with foreign currency, it can be fairly tranquil shortly after New York closing, with fewer orders and, as a consequence, the potential of abrupt price swings.