RELIABLE PALLADIUM FORECAST

Daily Accurate Palladium Trading Signals

1 Hour, 4 Hour, Daily & Weekly Elliott Wave Counts

Live analysis sessions and trading rooms

Daily technical videos, sequence reports & more…

Palladium Trading Signals

Trade with confidence with exclusive Elliott Wave Forecasts

Palladium is indeed a heavy metal that is grayish and shiny. PGM, or Platinum group metals, is formed from platinum, rhodium, chromium, iron oxide, and strontium. PGMs are very scarce. The sector accounted for just 0.003 ppm of the Continental mantle, as per the geologists. The platinum metals group comprises 6 metals that are particularly popular for their outstanding adsorption properties.

Palladium was synthesized in 1802 by English scientist William Hyde Wollaston. The pliable, gleaming material quickly acquired favor in the jewelry market. Palladium was converted from a premium commodity to a vital resource, avoiding air quality and introducing new automotive sector regulations.

Palladium has been primarily utilized in car emissions controls since 1988, which capture harmful pollutants whenever a motor consumes gasoline. Automobile manufacturers consume moreover 70 percent of the entire 206,000 kg of palladium mined each year. Palladium’s extraordinary capacity to digest hydrogen – 940 times more than its original volume – makes it highly useful in thermonuclear sectors.

We at Elliott Wave Forecast understand that not everyone can be a financial expert but that shouldn’t prevent you from taking advantage of such rewarding opportunity.

Why use Elliott Wave Forecast for Palladium?

Let our expert analysts help you trade the right side and blue boxes with timely and reliable Palladium forecasts.

- Daily & Weekly Technical Videos

- Live Chat Rooms

- Live Analysis Sessions

- Sequence Reports

- Free Education and Learning

- Live Trading Room Sessions

Don't take our word for it. See what our customers say

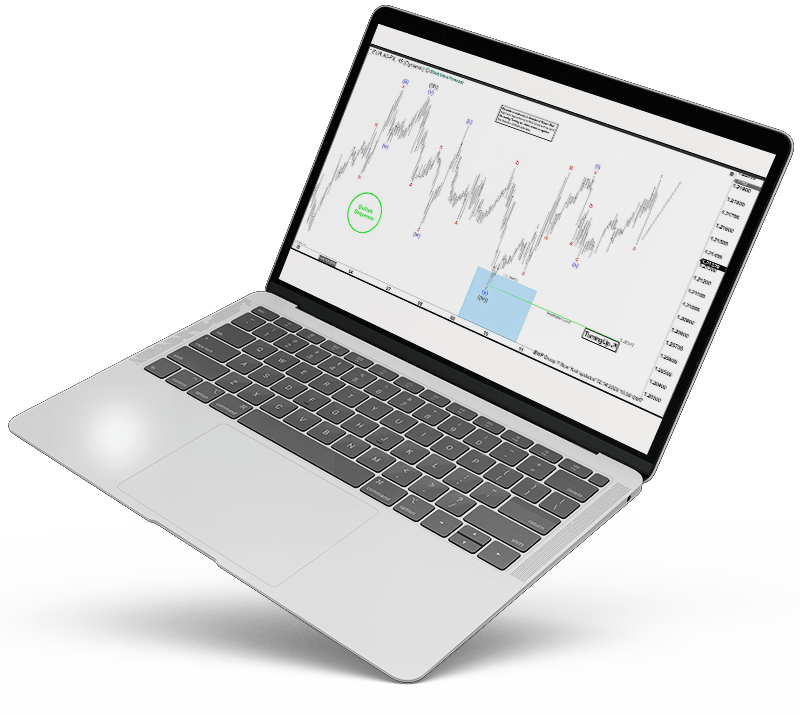

Palladium Forecast using the Blue Box Approach

Elliot Wave Forecast’s analysts and traders arrange high-frequency inflection regions of interest, where there is a greater chance of buyers and sellers agreeing to move in a particular direction in the future. This enables us to arrange precise entry points and determine if the trend will continue or whether a reversal will occur. At the Elliot wave prediction, these high-frequency inflection regions or exact entrance locations are marked and referred to as “Blue Boxes.” Furthermore, the blue boxes define and represent the 3,7, or 11 swings to finish. Furthermore, the blue boxes are coordinated and curated by combining Fibonacci extensions with additional technological techniques. These blue boxes are high-probability, low-risk regions of interest that have the potential to extract at least three swings on the right side of the trend direction.

Learn to trade the right side with blue boxes.

Palladium [20 April 2021]

Price reached the blue box and started turning higher. Members knew blue box was a buying area and Palladium should either resume the rally for a new high or bounce in 3 waves at least over the next few trading sessions

Palladium [22 April 2021]

Palladium found buyers in the blue box and rallied nearly $150 in the next couple of days. It made a new high above wave 3 peak providing nice profits for our members.

Palladium Forecast, News & Analysis

Check our updated for Palladium News including real-time updates, forecast, technical analysis and the economic latest events from the best source of Commodities News

Palladium Forecast & Signals

Investing In Palladium CFDs

CFDs are one of the simplest and most popular methods to trade palladium. A contract for difference (CFD) is a kind of agreement made between the client and a brokerage to benefit from the difference in price between starting and completing the purchase.

Dealing in palladium CFDs removes the risk of actually purchasing and holding the commodity. Furthermore, CFDs force the price of palladium across both sides. You may attempt to benefit either through upwards downward future market movements, regardless of if you have a generally negative opinion of the palladium market prognosis and forecasts.

Palladium trading

Currency speculation and CFDs are great methods to trade commodities like palladium, available on our Future Generations trading platform. Currency speculation is a tax-efficient** method of betting on the underlying assets’ price fluctuations. CFDs enable traders to buy or sell several commodity items, with the cost difference transferred at the execution of this provided contract. Traders who don’t wish to trade Palladium CFD could trade Palladium futures as well.

Palladium Technical Analysis

We undertake wide variety of technical tools for attaining our trade opportunities. As our name suggests, the primary technical tool we utilize is Elliott wave analysis. Our traders and analysts have been using this tool for many years. It has provided fruitful results for our clients and us. If you want to trade with experts who have years of experience in the markets, contact us now!

Elliott Wave Analysis

Elliot Wave Forecast’s traders and analysts use a broad range of tools and indicators to offer our customers the most nuanced and most informed, accurate trading choices. Because of the pair’s high volatility, our traders utilize Elliot Wave analysis to make USD CAD forecasts. The Elliot Wave analysis is a critical technique that allows traders to evaluate a particular pair’s general direction and trend. It also enables traders to forecast significant market movements in advance of their occurrence. When doing Elliot wave analysis on a specific pair, our traders use the Elliot wave structure. The Elliot wave structures are precise locations that enable us to evaluate and forecast a significant market move or prospective wave that will occur.

Furthermore, this allows us to remain on the right side of the trend and avoid “trading against the trend.” Our traders realize that trading against the trend may be hazardous to the accounts of inexperienced traders. As a result, we have created such tactics that align with our customers’ particular capabilities. Our services not only assist you in making money but also teach you the fundamentals and gist of sound technical analysis.

Furthermore, our traders use several techniques, including market correlations, sequences, market dynamics, wave structures, Fibonacci, trendlines, and Elliot wave analysis. Such technical facilities and analysis enable us to thoroughly examine any currency pair, commodity, stock, or asset class while remaining on the right side of the trend. These tools allow us to organize and select regions of the charts with a greater likelihood of trend continuance or trend reversal. These places of significance are prominently labeled as “Blue Boxes.”

Fibonacci

Fibonacci is a technique that is frequently utilized by most high-end investors and traders. Fibonacci’s nature is widespread, and traders may use it for scalping, day trading, swing trading, and even position trading. The Fibonacci tool assists you in locating specific regions of retracement and trend extensions at a price. For example, if a trend is rising (creating higher highs and lower lows), we will drag our Fibonacci tool from the trend’s low to its high. As a result, the golden Fibonacci number of 61.8 percent will serve as our primary retracement region for a further rise to the higher. Fibonacci is frequently employed in “buy the drop” and “sell the rise.” Elliot wave prediction traders heavily rely on Fibonacci in their technical arsenal. Fibonacci is used for several applications. For example, we utilize Fibonacci to achieve possible retracement levels, profit target levels (through Fibonacci extensions), and orchestrate our “Blue Boxes” high-frequency inflection regions. With Elliot wave prediction at your disposal, the days of searching Google for “USD vs. cad signals” are long gone.

Trendlines

Trendlines are simple lines often used technical tools. Most traders utilize it because of its simplicity and ease of usage. However, most beginner or intermediate-level traders are unaware of trendlines’ potential or do not know how to utilize them effectively. In a nutshell, trendlines are used to assess and comprehend the strength of a particular trend. For example, if the sketched trendline is steeper and more aligned, it indicates that the trend is strong. If the trendline is less steep and not aligned at all, it shows a fragile trend. The trendline helps us evaluate the strength of the movement and makes better trading choices. Elliot wave prediction experts utilize trendlines as a point of convergence for a variety of specialized techniques. For example, we use trendlines in conjunction with the RSI indicator and a custom distribution method. This enables us to determine the end of a particular cycle.

Correlations in the Market

According to different surveys and financial market reports, it is discovered that palladium is highly correlated with most of the currencies on the forex market. In essence, it has over 86% correlation with GBP/USD currency pair and over 84% correlation with the USDJPY forex pair. Our traders and analysts utilize extensive correlation methodologies at Elliot wave forecast, including first dimension and second dimension correlation techniques. This helps us attain a wider edge in trading any commodity, asset, or forex pair!

Primary Fundamental Drivers of Palladium Market Movement

There are numerous variables affecting palladium consumption, with the automobile sector becoming one of the most important. In Germany, customers are rapidly shifting away from petrol engines and toward gasoline vehicles, which utilize palladium instead of palladium in their emissions controls. The performance of the currency is another element influencing the palladium market. For illustration, if the price collapses in returns earned the Russian Ruble, profitability for Russian palladium miners that receive income in US dollars could suffer. As a result, there would be an opportunity to improve palladium availability to something like the international market, raising the valuable metal’s demand. Supply constraints can impact price fluctuations; since palladium is a supplementary commodity to platinum and silver, producers make it challenging to expand collection and production. A significant portion of palladium is produced in Africa. Rising infrastructure and energy prices have previously impacted palladium production levels, resulting in increased pricing.

Palladium is already one of the most extraordinary costly stones over the decades. Several traders have begun to regard it as a safe haven investment.